Bagley Risk Management Solutions: Your Guard Versus Unpredictability

Bagley Risk Management Solutions: Your Guard Versus Unpredictability

Blog Article

How Livestock Danger Protection (LRP) Insurance Can Protect Your Livestock Financial Investment

Livestock Risk Defense (LRP) insurance coverage stands as a trusted shield versus the uncertain nature of the market, supplying a calculated method to guarding your properties. By delving right into the complexities of LRP insurance coverage and its complex advantages, livestock manufacturers can fortify their investments with a layer of safety that goes beyond market variations.

Understanding Animals Risk Protection (LRP) Insurance Coverage

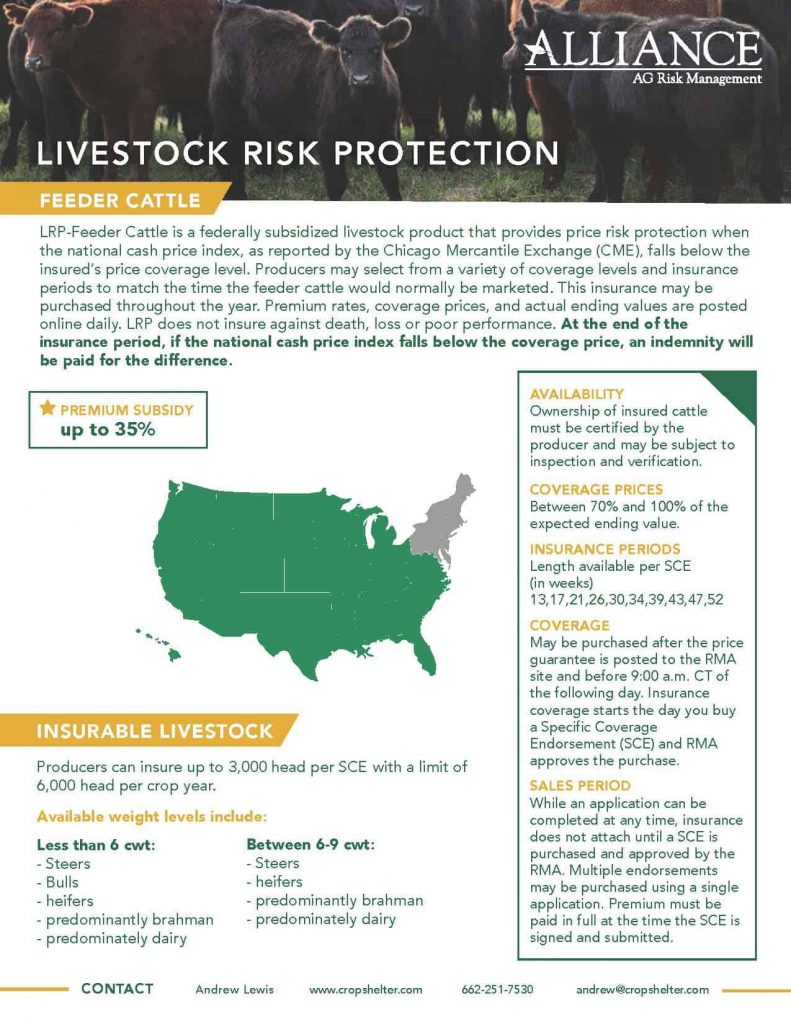

Understanding Livestock Threat Security (LRP) Insurance policy is crucial for livestock manufacturers aiming to alleviate financial dangers associated with cost variations. LRP is a government subsidized insurance coverage item created to secure producers versus a drop in market value. By giving coverage for market value decreases, LRP assists manufacturers secure a floor rate for their animals, ensuring a minimal level of earnings despite market fluctuations.

One key element of LRP is its adaptability, permitting manufacturers to customize insurance coverage levels and policy lengths to fit their particular needs. Producers can choose the variety of head, weight range, protection price, and coverage period that line up with their manufacturing objectives and take the chance of tolerance. Comprehending these customizable alternatives is essential for manufacturers to efficiently manage their cost threat exposure.

Additionally, LRP is readily available for numerous animals types, including livestock, swine, and lamb, making it a flexible risk management tool for animals manufacturers across various fields. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, manufacturers can make enlightened choices to guard their financial investments and ensure economic security in the face of market unpredictabilities

Advantages of LRP Insurance Policy for Animals Producers

Livestock producers leveraging Animals Danger Defense (LRP) Insurance policy get a strategic advantage in protecting their investments from price volatility and protecting a secure financial ground amidst market uncertainties. One crucial benefit of LRP Insurance coverage is rate protection. By establishing a floor on the cost of their animals, producers can reduce the risk of considerable economic losses in case of market recessions. This permits them to prepare their spending plans extra efficiently and make notified choices concerning their operations without the continuous fear of price fluctuations.

Additionally, LRP Insurance policy provides manufacturers with peace of mind. Generally, the advantages of LRP Insurance for animals manufacturers are substantial, offering a useful device for taking care of danger and making certain monetary safety in an unforeseeable market environment.

Just How LRP Insurance Mitigates Market Threats

Minimizing market dangers, Animals Risk Protection (LRP) Insurance provides animals manufacturers with a reputable shield versus cost volatility and financial unpredictabilities. By providing protection versus unexpected price drops, LRP Insurance aids producers protect their financial investments and keep monetary security despite market changes. This kind of insurance policy allows livestock manufacturers to secure a rate for their pets at the beginning of the plan duration, guaranteeing a minimal price level despite market modifications.

Steps to Safeguard Your Livestock Investment With LRP

In the realm of agricultural danger administration, applying Animals Danger Protection (LRP) Insurance coverage entails a strategic procedure to protect financial investments versus market fluctuations and unpredictabilities. To protect your animals investment effectively with LRP, the very first step is to examine the particular threats your procedure deals with, such as rate volatility or unforeseen weather condition occasions. Understanding these threats enables you to determine the insurance coverage degree required to secure your investment effectively. Next, it is critical to research study and select a credible insurance provider that uses LRP plans tailored to your livestock and business demands. Once you have chosen a company, thoroughly evaluate the policy terms, conditions, and protection limitations to ensure they align with your threat monitoring objectives. Furthermore, consistently keeping track of market patterns and adjusting your coverage as required can aid enhance your security versus prospective losses. By complying with these steps diligently, you can enhance the security of your animals financial investment and navigate market unpredictabilities with confidence.

Long-Term Financial Safety With LRP Insurance

Making sure enduring financial stability with the application of Animals Danger Defense (LRP) Insurance policy is a prudent lasting strategy for agricultural manufacturers. By integrating LRP Insurance policy into their risk management plans, farmers can protect their livestock investments versus unforeseen market fluctuations and damaging occasions that might threaten their economic well-being gradually.

One secret benefit of LRP Insurance for long-lasting economic security is the tranquility of mind it uses. With a reliable insurance plan in area, farmers can mitigate the check these guys out monetary threats linked with unstable market problems and unforeseen losses due to aspects such as illness break outs or natural calamities - Bagley Risk Management. This stability allows manufacturers to focus on the everyday click to investigate operations of their animals business without continuous bother with potential monetary troubles

Additionally, LRP Insurance policy supplies a structured technique to handling threat over the lengthy term. By setting specific protection levels and picking suitable endorsement periods, farmers can tailor their insurance plans to align with their economic objectives and take the chance of resistance, ensuring a secure and sustainable future for their livestock operations. In final thought, spending in LRP Insurance is a positive approach for agricultural producers to attain long lasting financial safety and secure their resources.

Verdict

In conclusion, Livestock Risk Protection (LRP) Insurance policy is an important tool for livestock producers to reduce market dangers and secure their financial investments. It is a wise selection for guarding animals investments.

Report this page